Market Update

Bank of Canada governor Tiff Macklem, right, and Carolyn Rogers, senior deputy governor, speak to reporters in Ottawa on Wednesday. The bank announced it was leaving its key overnight lending rate unchanged at five per cent, citing inflation and concerns it would be forced to backtrack. (Sean Kilpatrick/The Canadian Press)

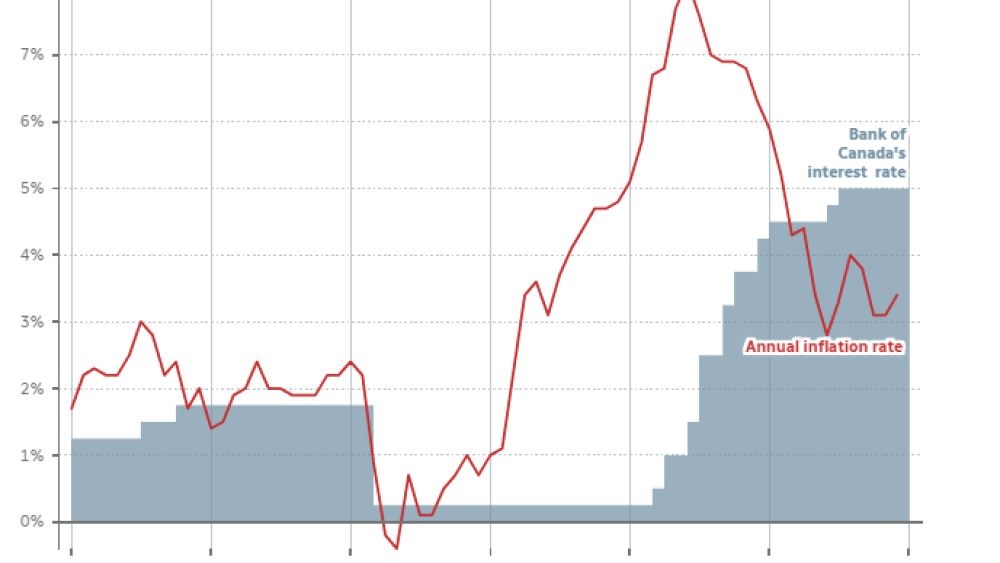

Weary Canadian households, clobbered by nearly two years of rising prices and skyrocketing interest rates, will have to wait a little longer for relief on their borrowing costs. The Bank of Canada left its key overnight lending rate unchanged at five per cent on Wednesday, citing the persistence in underlying inflation and concerns that it might declare victory too soon and be forced to backtrack. But the bank says it has shifted from whether rates are high enough to how long rates need to remain elevated.

“If the economy evolves broadly in line with the projection we published today, I expect future discussions will be about how long we maintain the policy rate at five per cent,” central bank governor Tiff Macklem said at a news conference in Ottawa. The obvious question, then, is when rates might begin to fall. On that, the Bank of Canada won’t say. “It is important that we don’t give Canadians a false sense of precision,” Macklem told reporters.

TD economist says U.S. inflation is slowing faster than Canada’s

Inflation appears to be receding faster in the U.S. than it is in Canada, and a TD economist says that’s because of different central bank mandates and methodology between the two countries. On Friday, the U.S. government reported year-over-year inflation of 2.6 per cent for December, while Statistics Canada reported last week that Canada’s core inflation climbed to 3.4 per cent that same month. Beata Caranci, chief economist at TD Bank, said one reason the U.S. appears to have tamed inflation more effectively than Canada is because data is calculated differently in each country. In the U.S., shelter costs amount to 15 per cent of the core goods calculation. In Canada, shelter represents 30 per cent of that calculation, which will make it harder for Canada to reach its goal of bringing inflation down to two per cent, she said. “They’re both rising at about six per cent, but it’s double the weight in terms of Canada and how much it’s captured,” Caranci told BNN Bloomberg in a Friday interview.

Inflation appears to be receding faster in the U.S. than it is in Canada, and a TD economist says that’s because of different central bank mandates and methodology between the two countries. On Friday, the U.S. government reported year-over-year inflation of 2.6 per cent for December, while Statistics Canada reported last week that Canada’s core inflation climbed to 3.4 per cent that same month. Beata Caranci, chief economist at TD Bank, said one reason the U.S. appears to have tamed inflation more effectively than Canada is because data is calculated differently in each country.

In the U.S., shelter costs amount to 15 per cent of the core goods calculation. In Canada, shelter represents 30 per cent of that calculation, which will make it harder for Canada to reach its goal of bringing inflation down to two per cent, she said. “They’re both rising at about six per cent, but it’s double the weight in terms of Canada and how much it’s captured,” Caranci told BNN Bloomberg in a Friday interview.

“It’s going to make it a lot harder for the Bank of Canada to hit the number they want to hit when you have an aspect of your methodology that’s heavily tied to a segment of the economy that they have very little control over right now.” Other factors outside the central bank’s control, including tensions in the Middle East, are also making it harder to achieve the central banks’ goal, Caranci added.

Differing mandates between the central banks are also playing a role, Caranci added, as the Bank of Canada has a more singular mandate of maintaining inflation, but the Fed has a dual mandate of controlling inflation and maintaining balance in the job market. “That’s why we continue to see (the Bank of Canada) and hear them talk tough on inflation,” she said. “The numbers are better than I think is being communicated perhaps by the Bank of Canada, because they want to make sure they’re anchoring expectations.”

You’re just one step away!

- Market data is limited for this property

- State laws limit the disclosure of this information

- This property is unique and the value cannot be estimated